A surrender charge also called a contingent deferred sales charges or a back end load is a fee you incur when you sell cash in or cancel certain types of investments insurance policies or annuities during a pre set number of years known as a surrender period. A surrender charge is an amount of money that may be charged by a life insurance company when you cancel your life insurance policy.

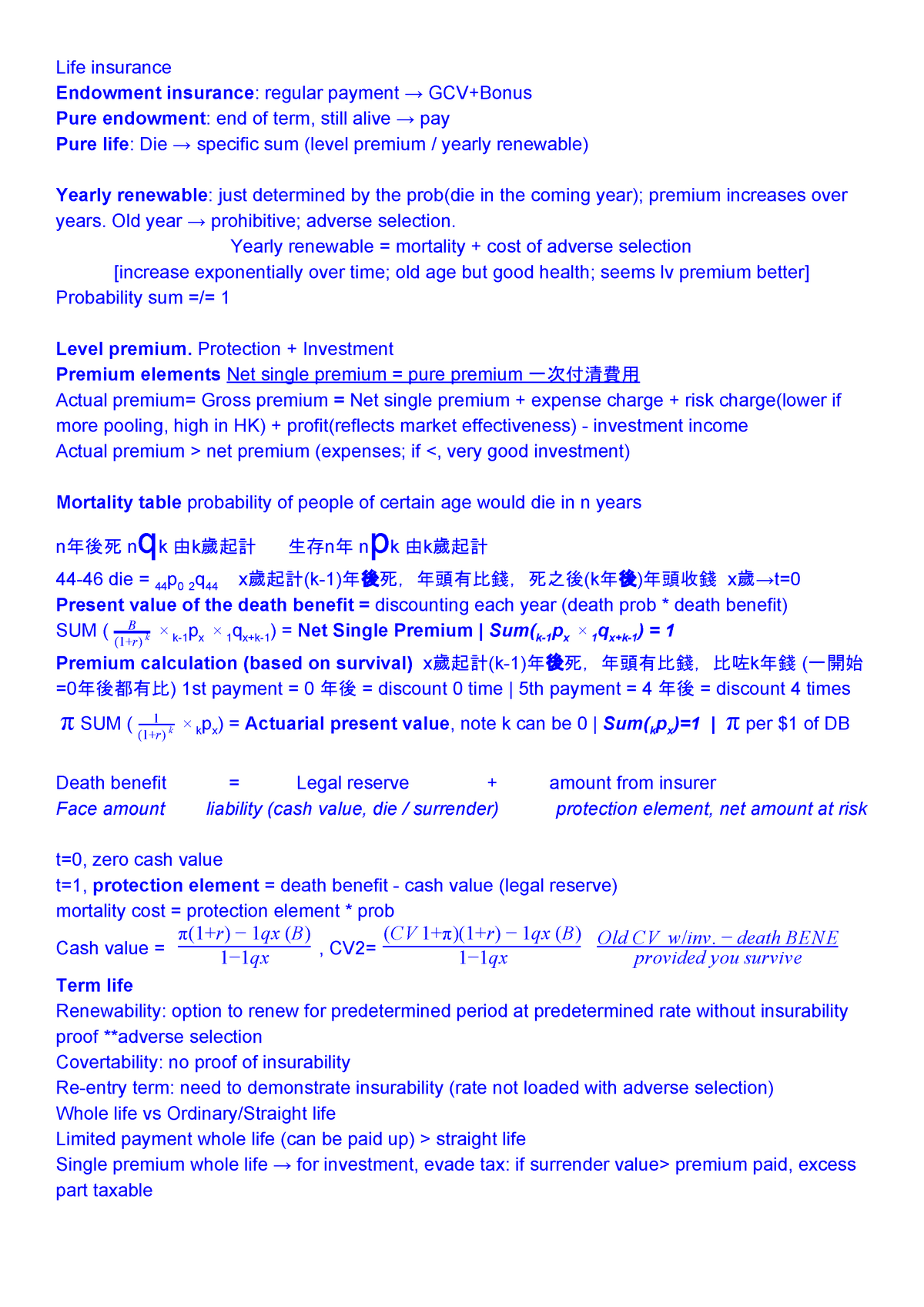

Cheat Sheet Summary Insurance Theory And Practice Hku Studocu

Cheat Sheet Summary Insurance Theory And Practice Hku Studocu

Most annuity providers tack on hefty charges if you surrender the contract.

Surrender charge life insurance. To receive the cash value the policyholder surrenders their rights to future benefits under the policy. A surrender charge is also known as a surrender fee. This type of fee generally is charged when an individual cancels a life insurance policy within a certain number of years after opening the policy.

If your annuity is qualified you cant deduct the surrender charge or recognize the loss. Surrender charges are the fees that your life insurance company takes out of your cash value if you cancel your policy early. When you surrender the annuity youll receive the current cash value minus the surrender charge.

If you have a whole life policy the chances are high that your policy is subjected to a surrender charge or fee if one were to decide to end their policy early but still want to receive some cash value that the policy has accrued. The amount might decrease over time and disappear after a set number of years. For the latter it typically decreases as time elapses.

Life insurance companies pay their agents a large commission when the policy is first sold. The cash value of an insurance contract also called the cash surrender value or surrender value is the cash amount offered to the policyowner by the issuing life carrier upon cancellation of the contractthis term is normally used with a life insurance or life annuity contract. Does your life insurance policy have a surrender charge.

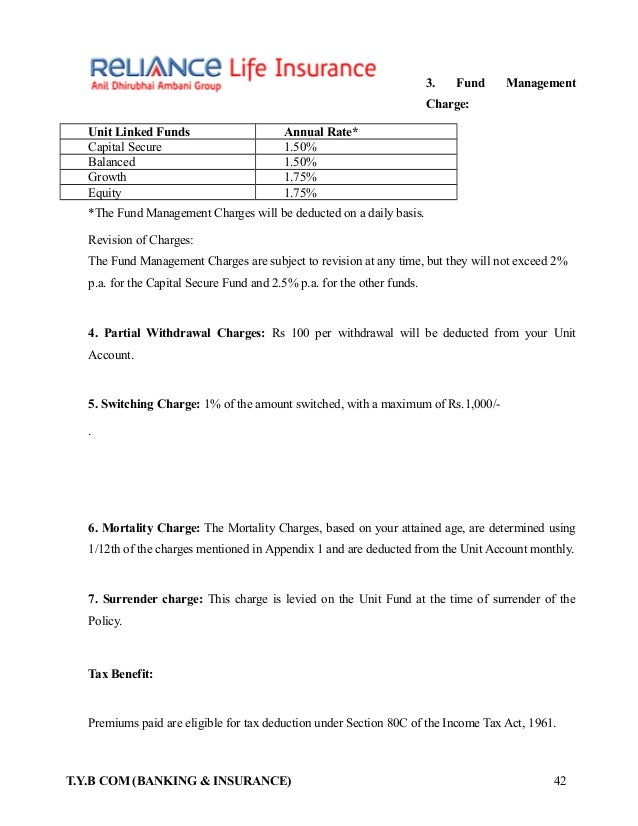

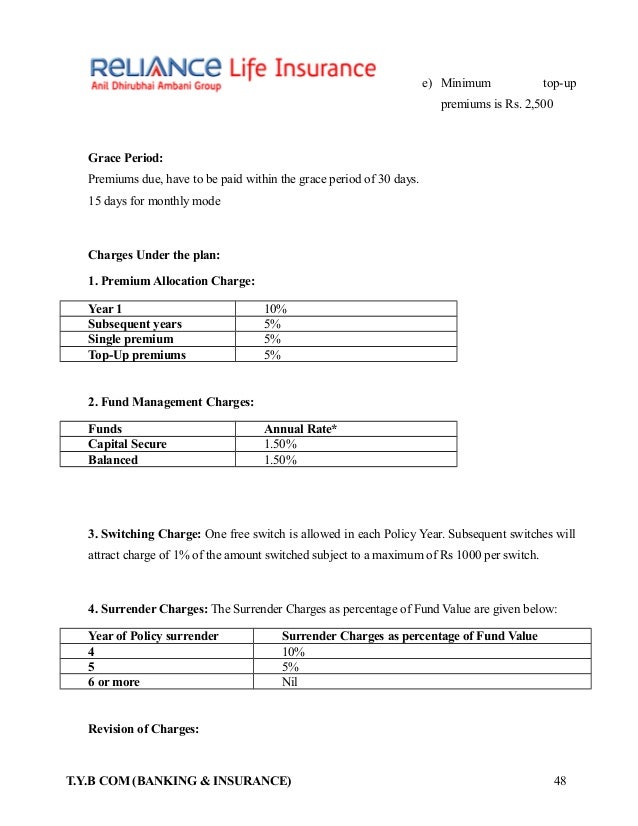

A surrender charge is the fee imposed when a policyholder cancels their life insurance or withdraws money from the savings component before it matures. Also most investments that carry a surrender charge such as b share mutual funds annuities and whole life insurance pay upfront commissions to the salespeople who sell themthe issuing. As provided in the provisions of a life insurance policy or annuity contract surrender charges are charges an insurance company may deduct if the owner surrenders a life insurance policy or annuity contract for the cash or accumulation value.

Surrender charge schedules on ul insurance policies typically last from 10 to 20 years to help the insurance company recoup the costs of selling the policy if a policyholder cashes in his or her.

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Should You Keep Or Surrender A Universal Life Policy

Should You Keep Or Surrender A Universal Life Policy

8 Marks George 50 Has Purchased A Whole Life Po Chegg Com

8 Marks George 50 Has Purchased A Whole Life Po Chegg Com

Breaking Down Annuity Fees And Charges Smartasset

Breaking Down Annuity Fees And Charges Smartasset

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

Life Insurance Illustration Pdf Free Download

Life Insurance Illustration Pdf Free Download

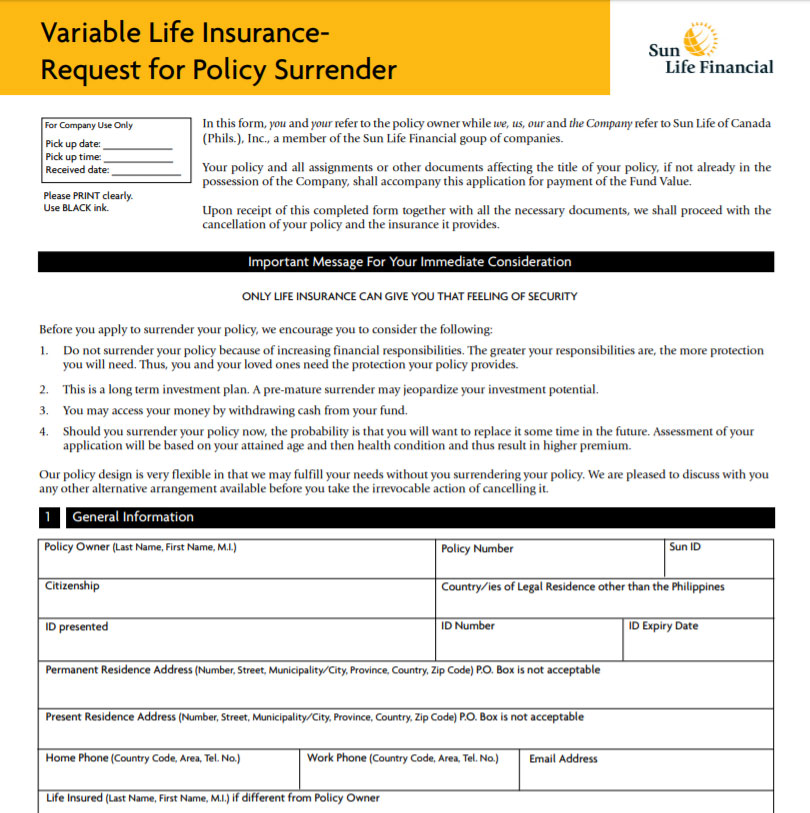

How To Surrender Vul Policy My Financial Advisor Ph

How To Surrender Vul Policy My Financial Advisor Ph

Federal Register Updated Disclosure Requirements And Summary

Federal Register Updated Disclosure Requirements And Summary

What Is A Life Insurance Surrender All About Surrendering A Policy

What Is A Life Insurance Surrender All About Surrendering A Policy

15 Best Guaranteed Universal Life Insurance Companies Reviewed

15 Best Guaranteed Universal Life Insurance Companies Reviewed

Go For Max Life Insurance And Regret Later Max Life Insurance

Go For Max Life Insurance And Regret Later Max Life Insurance

Ilas Total Fees And Charges Disclosure The Chin Family

Ilas Total Fees And Charges Disclosure The Chin Family

Checklist For Buying Life Insurance Policy

Checklist For Buying Life Insurance Policy

Variable Universal Life Accumulator Nationwide

Variable Universal Life Accumulator Nationwide

Glossary Of Life Insurance Terms Smartasset Com

Glossary Of Life Insurance Terms Smartasset Com

Life Insurance Policy Surrender Want To Surrender Your Life

Life Insurance Policy Surrender Want To Surrender Your Life

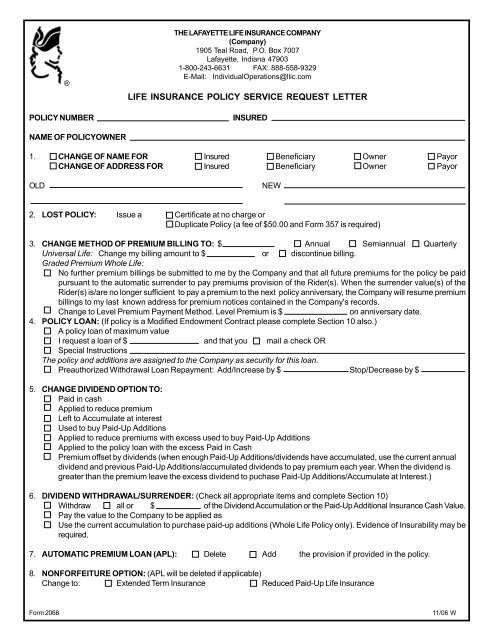

Life Insurance Policy Service Request Letter Secure Your Future

Life Insurance Policy Service Request Letter Secure Your Future

Free Financial Planning Life Insurance 301 Universal Life Policy

Free Financial Planning Life Insurance 301 Universal Life Policy

Life Insurance Illustration Pdf Free Download

Life Insurance Illustration Pdf Free Download