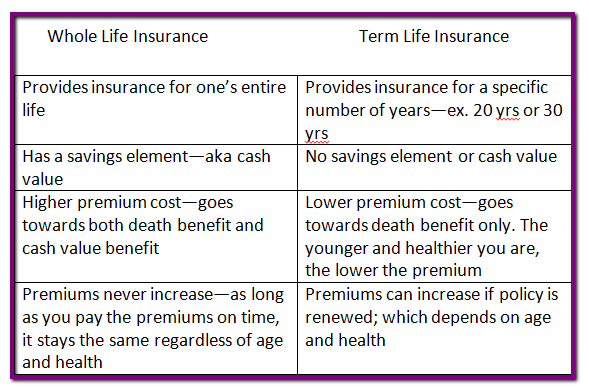

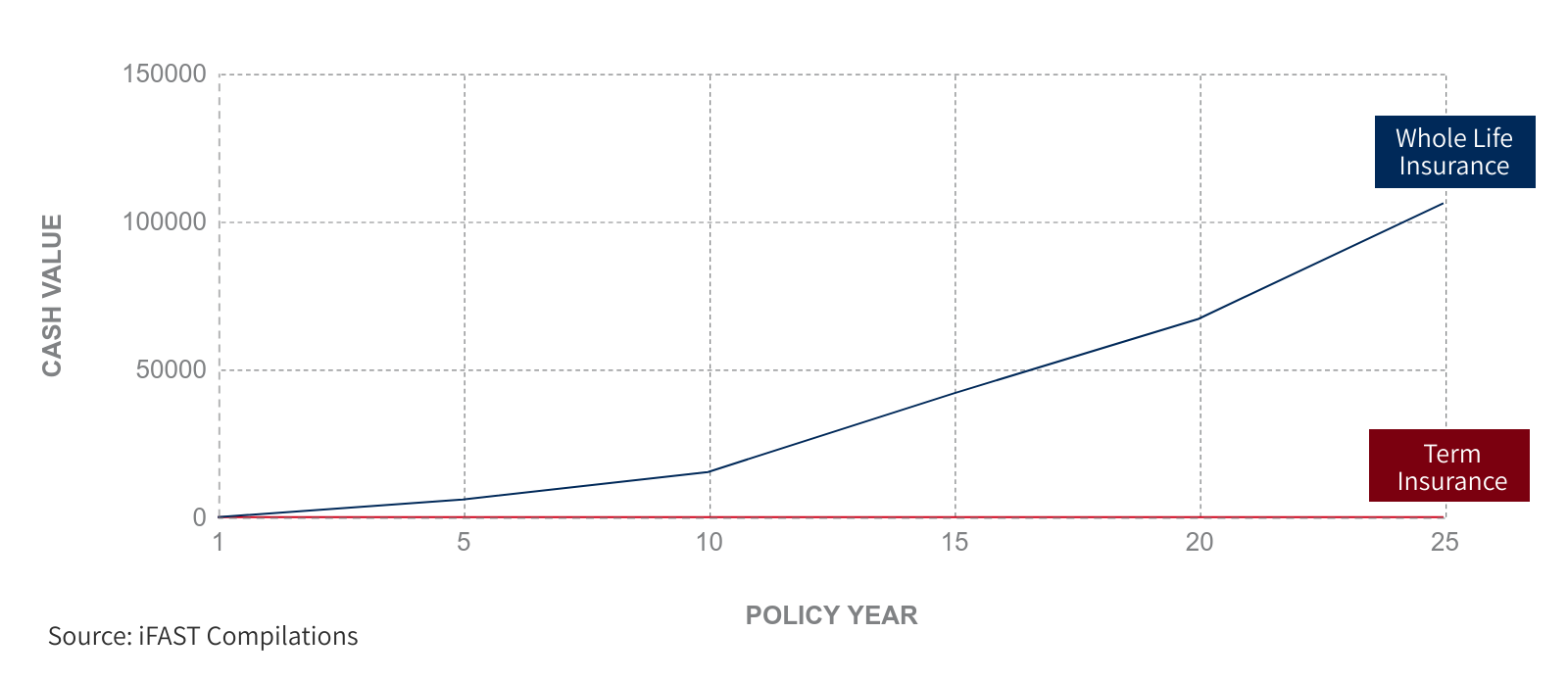

This is because the insurance company knows theres a chance you can outlive the policy in which case it doesnt have to pay the benefit. The main difference between term life insurance and whole life insurance is that term life insurance serves as insurance only whereas whole life insurance is actually insurance plus investment.

How To Find Out If Someone Has A Life Insurance Policy Quotacy

How To Find Out If Someone Has A Life Insurance Policy Quotacy

Do you need term life insurance or whole life insurance.

Term vs whole life insurance definition. A term life insurance policy has 3 main components face amo. For most people term life insurance is less expensive than whole life insurance. Both types of plans offer renewal based on making payments on time not on your current health.

Annual renewable term and level premium term. But most people can start shopping by making one key decision. Term life insurance vs whole life insurance comparison.

Now that you know the differences between term life insurance and whole life insurance you can make an informed choice to find the best life insurance solution for you and your family. Looking at the types of term plans available can also help you understand the differences between a whole life vs term life definition. Term life insurance policies come in two basic flavors.

Both types have their benefits and drawbacks. Compare cost and policy features. Term life is typically better for people who want affordable coverage in the unlikely event of their earlier than expected death especially during a critical time in life such as parenting young children or taking on a larger mortgage.

In the simplest of terms its not worth anything unless one of you were to die during the course of the term. Term life insurance is cheap because its temporary and has no cash value. When making your life insurance decision the main thing you need to know are the differences between term and whole life insurance.

The easiest way to remember the difference is to think of term as temporary insurance and whole life as permanent insurance which remains in force until the day you die or until you are 120 years of age whichever comes first. Term life insurance is affordable and straightforward while whole life doesnt expire but is more expensive. Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries so long as the contract is up to date at the time or the policyholders death.

Find out more by contacting an insurance agent in your area. Term life insurance plans are much more affordable than whole life insurance. Whole life insurance costs more because it lasts a lifetime and does have cash value.

This is because the term life policy has no cash value until you or your spouse passes away. Whole life insurance cost comparison. Buying life insurance seems daunting.

Life Insurance Policies Life Insurance Policies Term Vs Whole

Life Insurance Policies Life Insurance Policies Term Vs Whole

Whole Life Insurance Comparison Chart Parta Innovations2019 Org

Whole Life Insurance Comparison Chart Parta Innovations2019 Org

Whole Vs Term Life Insurance Ntuc Income

Whole Vs Term Life Insurance Ntuc Income

Universal Life Insurance Definition

Universal Life Insurance Definition

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

What Are The Different Types Of Life Insurance Policies Market

What Are The Different Types Of Life Insurance Policies Market

/GettyImages-494765811-5ac3920fc5542e0037b4ab4b.jpg) Best Whole Life Insurance Policies Of 2020

Best Whole Life Insurance Policies Of 2020

![]() A Basic Life Insurance Definition For 2019

A Basic Life Insurance Definition For 2019

Whole Life Insurance Definition Economics Senior Life Insurance

Whole Life Insurance Definition Economics Senior Life Insurance

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Is Life Insurance For Children A Waste Of Money

Is Life Insurance For Children A Waste Of Money

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Best Graded Life Insurance Whole Life Insurance Policy Definition

Best Graded Life Insurance Whole Life Insurance Policy Definition

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Term Insurance Vs Whole Life Insurance What To Choose

Term Insurance Vs Whole Life Insurance What To Choose

How To Switch From Whole To Term Life Insurance Thomas Fenner

How To Switch From Whole To Term Life Insurance Thomas Fenner

When Is Whole Life Insurance The Better Option

When Is Whole Life Insurance The Better Option

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com