The strategy has also been known to double even triple after tax income compared to a 401k or 403b retirement plan. Use life insurance for a tax free estate plan new policies for older investors are costly but offer attractive tax free benefits for heirs.

Because Life Insurance May Be The Most Underused Strategy To

Because Life Insurance May Be The Most Underused Strategy To

Life insurance when used properly can help supercharge a retirement plan by make the plan more tax efficient providing peace of mind improving total portfolio returns and creating a source of.

Tax free retirement income life insurance. Beyond the roth ira. Life insurance for tax free retirement income your clients should be worried about more than just the risk of outliving retirement savings. Life insurance protects your family from your financial debts and obligations after you die by providing a death benefit but it also may be used for business purposes to compensate a company for the loss of a key person in the company.

This retirement strategy the tax free pension alternativeis also known as living benefit life insurance and the tax free iul. For instance you can draw tax free retirement income from your life insurance policy if you structure it correctly with the help of an expert advisor. In our opinion as part of your tax reducing retirement strategy you should take a serious look at max funded tax advantaged insurance contracts as an option for developing a tax free retirement.

Of course like any life insurance policy you must be insurable. Life insurance is a vastly underutilized opportunity for maximizing and maintaining wealth for your retirementtax free under many circumstances. Tax free retirementliving a comfortable life in retirement without the obligation to pay income taxcomes as the result of planning and arranging your finances following irs guidelines every step of the way so that when you retire none of the money you receive is taxableperhaps not even your social security income.

Life insurance proceeds may be tax free depending on what proceeds you or your beneficiaries receive. The tax free iul can produce a tax free income you wont outlive. Our life insurance advisors have decades of experience advising on retirement income and estate planning.

Life insurance policies are not investments and accordingly should not be purchased as an investment. How to get tax free retirement income with life insurance life insurance can be used to secure tax free income both in the accumulation phase and the distribution phase. If you want to generate more tax free income for your retirement and do it with no market risk and more efficiency than other financial vehicles speak with us.

A myriad of taxes even in. Protect yourself from increased taxes.

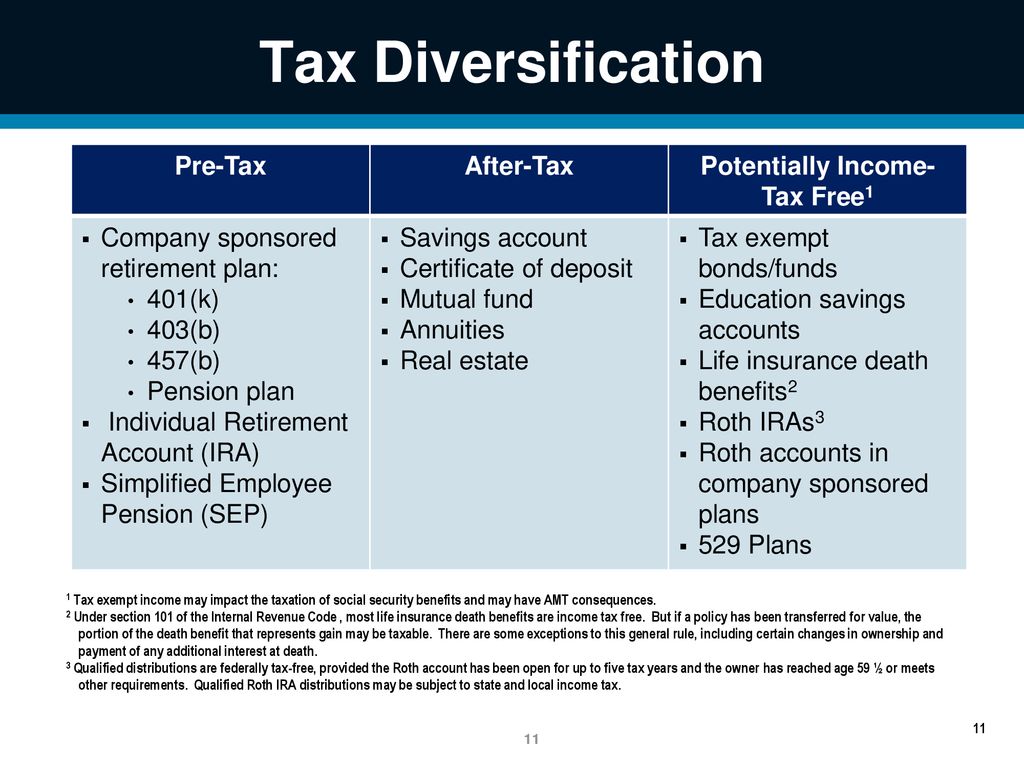

Financial Planning Can Make Ppt Download

Financial Planning Can Make Ppt Download

5 Of The Best Retirement Fund Methods In The Philippines Fwd

5 Of The Best Retirement Fund Methods In The Philippines Fwd

Chapter 18 Starting Early Retirement Planning Ppt Download

Chapter 18 Starting Early Retirement Planning Ppt Download

Documents Needed For Tax Free Iul Application Video Discusses The

Documents Needed For Tax Free Iul Application Video Discusses The

Cash Value Life Insurance Build More Cash Get Quotes

Cash Value Life Insurance Build More Cash Get Quotes

Cash Value Life Insurance In Retirement Planning Insurance Fiduciary

Cash Value Life Insurance In Retirement Planning Insurance Fiduciary

Not Enough Income In Retirement How To Fix That

Not Enough Income In Retirement How To Fix That

Retirement Income Options Retirement Income Tax Net Income

Retirement Income Options Retirement Income Tax Net Income

Annuities And Life Insurance For Retirement Allianz Life

Annuities And Life Insurance For Retirement Allianz Life

Financial Planning Seminar February 21 Gft

Financial Planning Seminar February 21 Gft

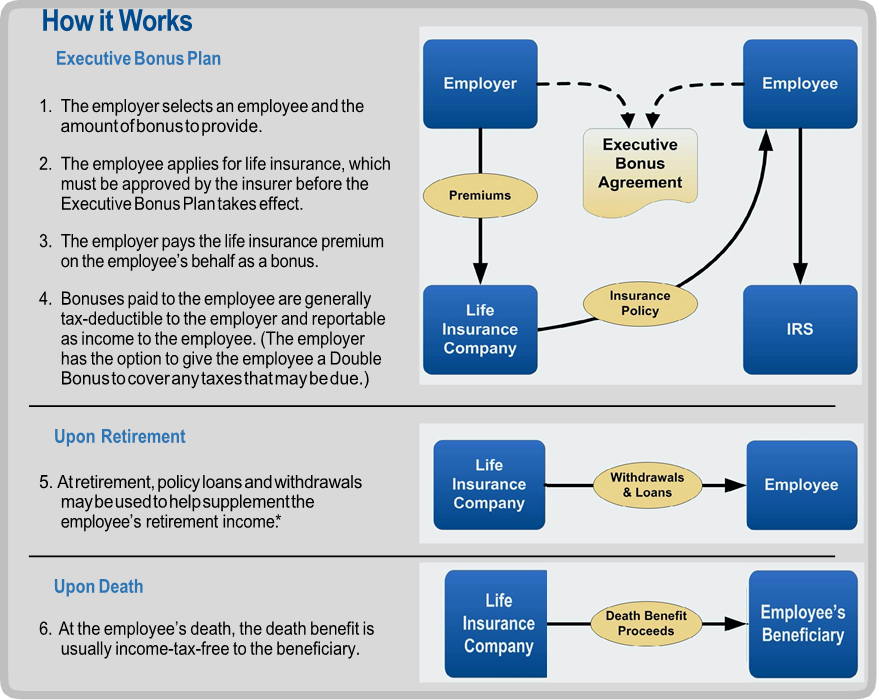

Executive Compensation Bonus Plan Gulfport Ms Mayfield

Executive Compensation Bonus Plan Gulfport Ms Mayfield

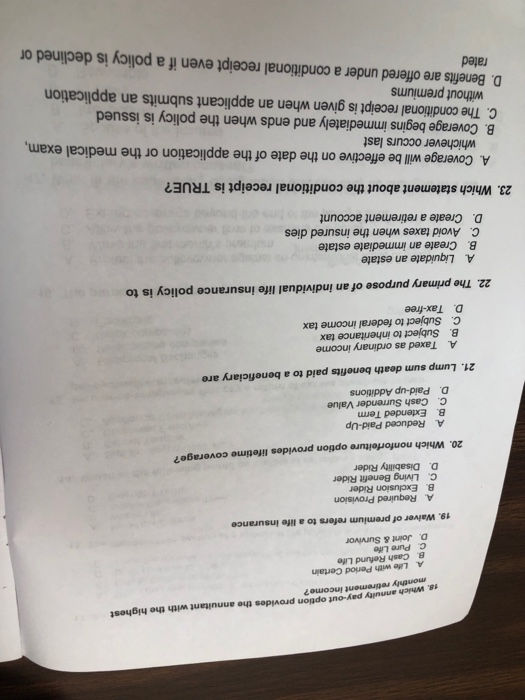

Solved 12 A Statement Of Good Health Is Required A When

Solved 12 A Statement Of Good Health Is Required A When

Protection Now Income Later Pdf Free Download

Protection Now Income Later Pdf Free Download

Too Good To Be True Lifetime Tax Free Retirement Income Konnor

Too Good To Be True Lifetime Tax Free Retirement Income Konnor

Tim Padgett Retirement Planning Tim Padgett Financial Planner

Tim Padgett Retirement Planning Tim Padgett Financial Planner

Brokers Alliance Life Insurance Services Ul Iul

Brokers Alliance Life Insurance Services Ul Iul

Lirps For The Average Joe Ogletree Financial

Lirps For The Average Joe Ogletree Financial

Irs Approved Tax Free Retirementindex Universal Life Home

Irs Approved Tax Free Retirementindex Universal Life Home