This tax free exclusion also. This is part two of a series on tax and insurance.

Federal Income Taxation Of Life Insurance Companies Lexisnexis Store

Federal Income Taxation Of Life Insurance Companies Lexisnexis Store

No sales tax is added or charged.

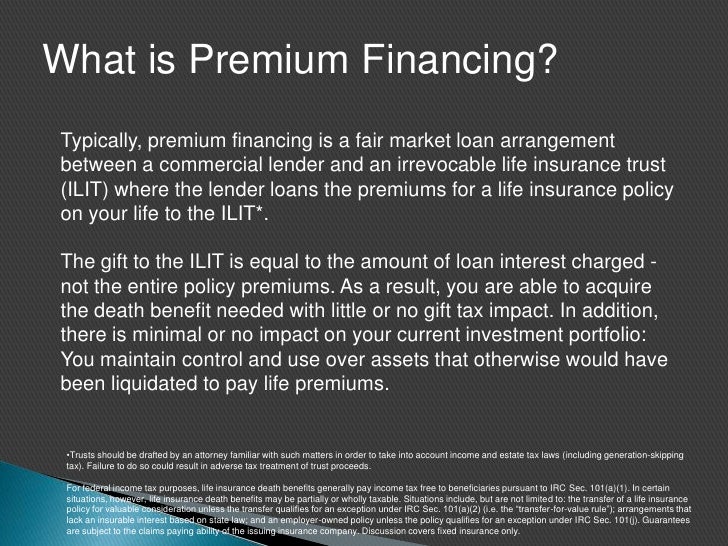

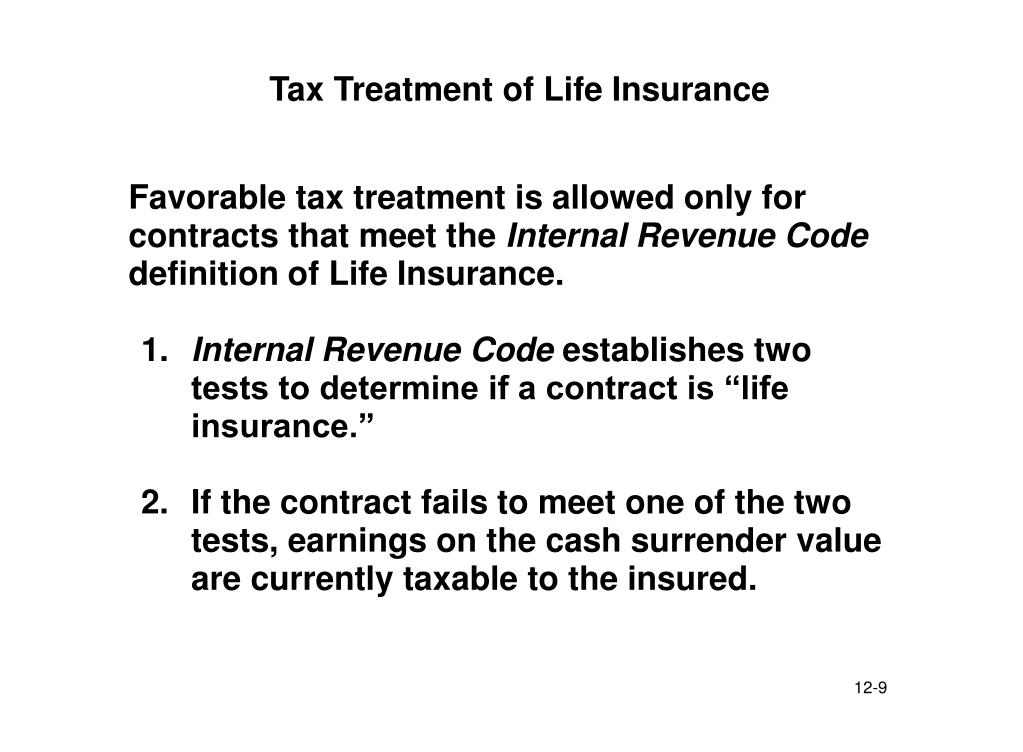

Tax treatment of life insurance. Life insurance has traditionally enjoyed substantial tax advantages in comparison to other financial products. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. See topic 403 for more information about interest.

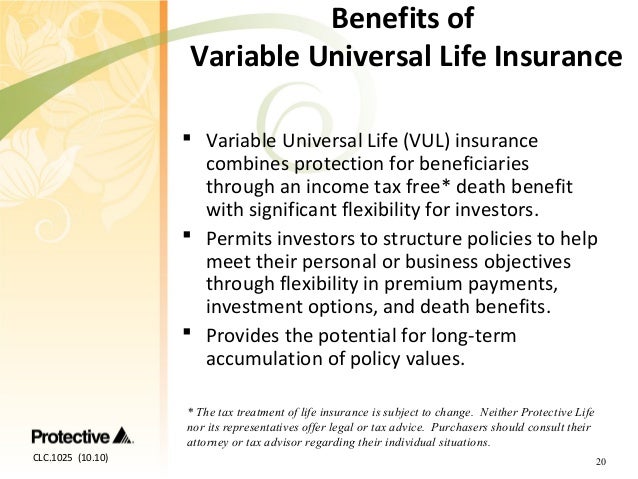

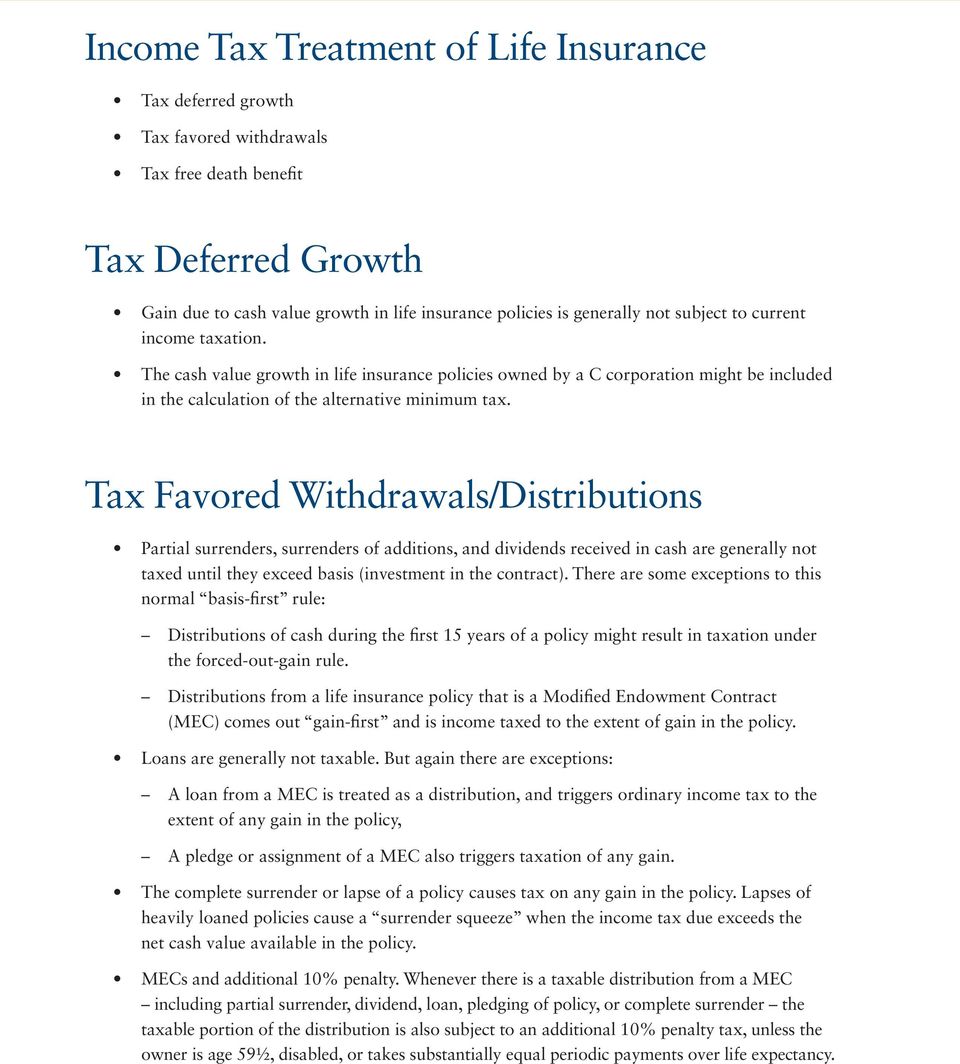

Group term life insurance policy where employees are the intended beneficiaries either because the employees are the named beneficiaries or there is a contractual obligation for the employer to pass the payout to the employees or their next of kin. In general the cash reserve within an exempt policy can accumulate on a tax deferred basis and the death benefit payable under the policy is tax free. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them.

In a nutshell the cash value in a permanent policy grows on a tax deferred basis and the death benefit is received income tax free. Consult a tax or insurance professional if you require assistance with the tax treatment of your policy. Life insurance premiums under most circumstances are not taxedie.

Most of the time proceeds arent taxable. If your life insurance policy is part of your estate at the time of your death the proceeds may be subject to federal estate taxes. In part one we talked about the tax attributes of life insurance.

While the contents this proverb is inevitable at least you can be reassured knowing that life insurance proceeds are paid out tax free. Your estate is taxed if the total value of the property you own including your life insurance policy exceeds the irs guidelines. But there are certain.

Below are examples of insurance premiums that are deductible. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. Though as you can see taxation of other aspects of life insurance can be quite complicated.

These premiums are also not tax deductible. Tax treatment of life insurance policies tax alert march 2015 inland revenue recently undertook a review of all public information bulletins pib and as a result identified out of date items that needed replacing. However any interest you receive is taxable and you should report it as interest received.

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Financial Planner Strategies To Reduce Volatility And Improve Tax

Financial Planner Strategies To Reduce Volatility And Improve Tax

Ppt Unique Characteristics Of Life Insurance Powerpoint

Ppt Unique Characteristics Of Life Insurance Powerpoint

Whole Life Insurance Tax Treatment Canada Life Insurance License

Whole Life Insurance Tax Treatment Canada Life Insurance License

Crafting A Better Consumption Tax The Accj Journal

Crafting A Better Consumption Tax The Accj Journal

Relevant Life Policy Tax Treatment Business Cover Expert

Relevant Life Policy Tax Treatment Business Cover Expert

Taxation Of Life Insurance Savings Insurancerise

Taxation Of Life Insurance Savings Insurancerise

Tax Benefits Of Life Insurance Life Insurance Tax Treatment

Tax Benefits Of Life Insurance Life Insurance Tax Treatment

Background And Issues Relating To The Tax Treatment Of Single

Background And Issues Relating To The Tax Treatment Of Single

Life Insurance Company To Cancel The Sale Of Tax Saving Insurance

Life Insurance Company To Cancel The Sale Of Tax Saving Insurance

Clc 1025 Life Insurance And You Covering The Basics Of Life Insuran

Clc 1025 Life Insurance And You Covering The Basics Of Life Insuran

Partial Surrender Of Life Insurance Policies Informal Consultation

Partial Surrender Of Life Insurance Policies Informal Consultation

:max_bytes(150000):strip_icc()/retirement_piggy_bank-5bfc2fbb46e0fb0051459a09.jpg) Permanent Life Insurance Definition

Permanent Life Insurance Definition

Today S Lecture 14 Life Insurance How Life Insurance Works

Today S Lecture 14 Life Insurance How Life Insurance Works

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Ppt Understanding Life Insurance Powerpoint Presentation Free

Ppt Understanding Life Insurance Powerpoint Presentation Free

Tax Treatment Taxability Of Various Financial Investments

Tax Treatment Taxability Of Various Financial Investments

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Tax Treatment Of Wealth Transfers Download Table

Tax Treatment Of Wealth Transfers Download Table

Form Of Application Icc12 Axa Ltc

Form Of Application Icc12 Axa Ltc

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To