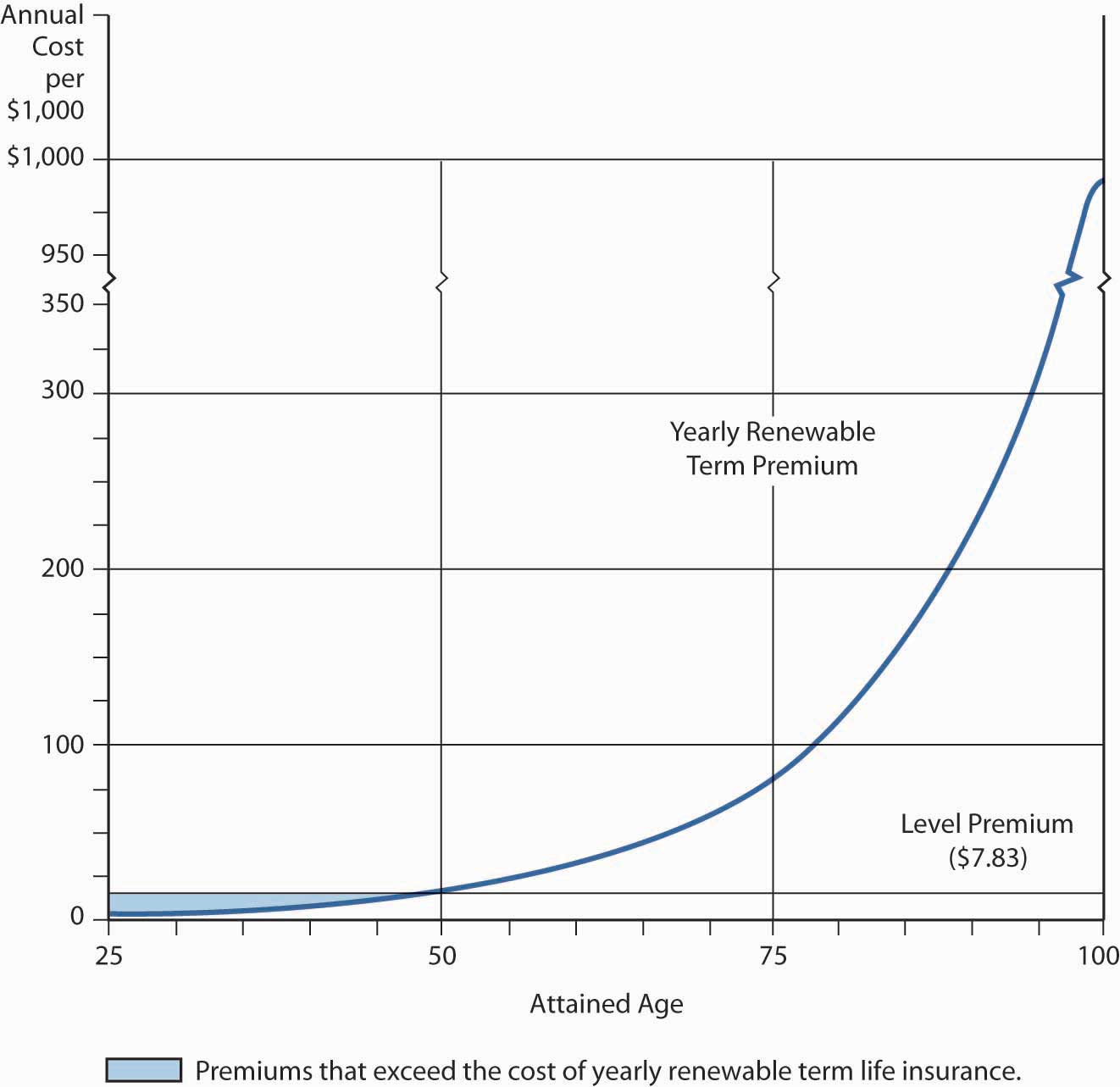

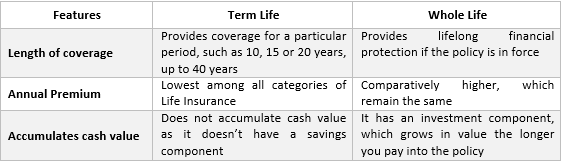

Term insurance has a low cost up front because it does not have a cash value accumulation. Life insurance provides financial security for those you leave behind after your death whether it be paying for school or transferring wealth.

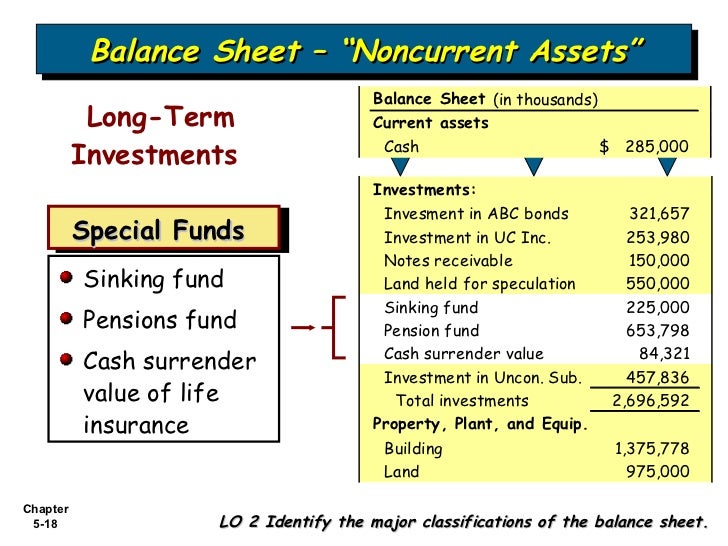

Solved Buildings Cash In Bank Cash On Hand Cash Surren

Solved Buildings Cash In Bank Cash On Hand Cash Surren

No term life insurance does not have a cash surrender value in most cases.

/GettyImages-926129268-635036cfea674e89bd4153eda9c0f951.jpg)

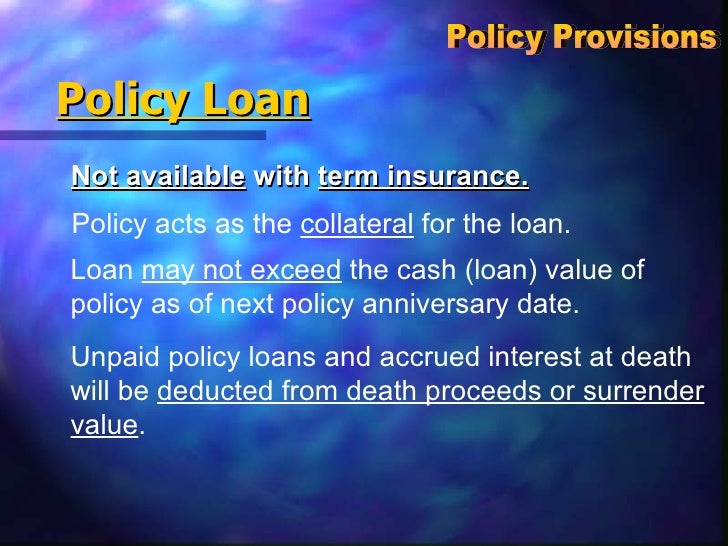

Term life insurance cash surrender value. Term life insurance cash surrender value if you are looking for the best insurance then our insurance quotes service can give you options to find a plan you are happy with. Term life insurance is usually the cheapest kind of life insurance to buy because it has no cash surrender value and it lasts for only a certain number of years such as 10 20 or 30. Permanent life insurance also called cash value life insurance is an entire category of life insurance plans that last as long as you pay the premiums and has a cash value component.

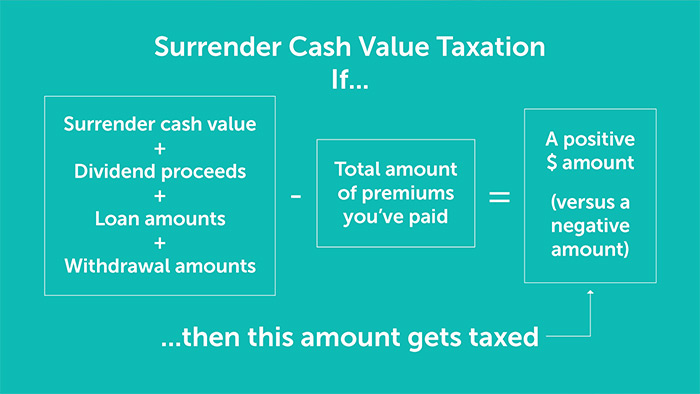

Fees are taken from the cash value before you get the pay out. If you decide to end a term life insurance policy you wouldnt get any money back because theres no cash value. Term coverage doesnt typically have a surrender value though with some policies you can at least recover your premiums.

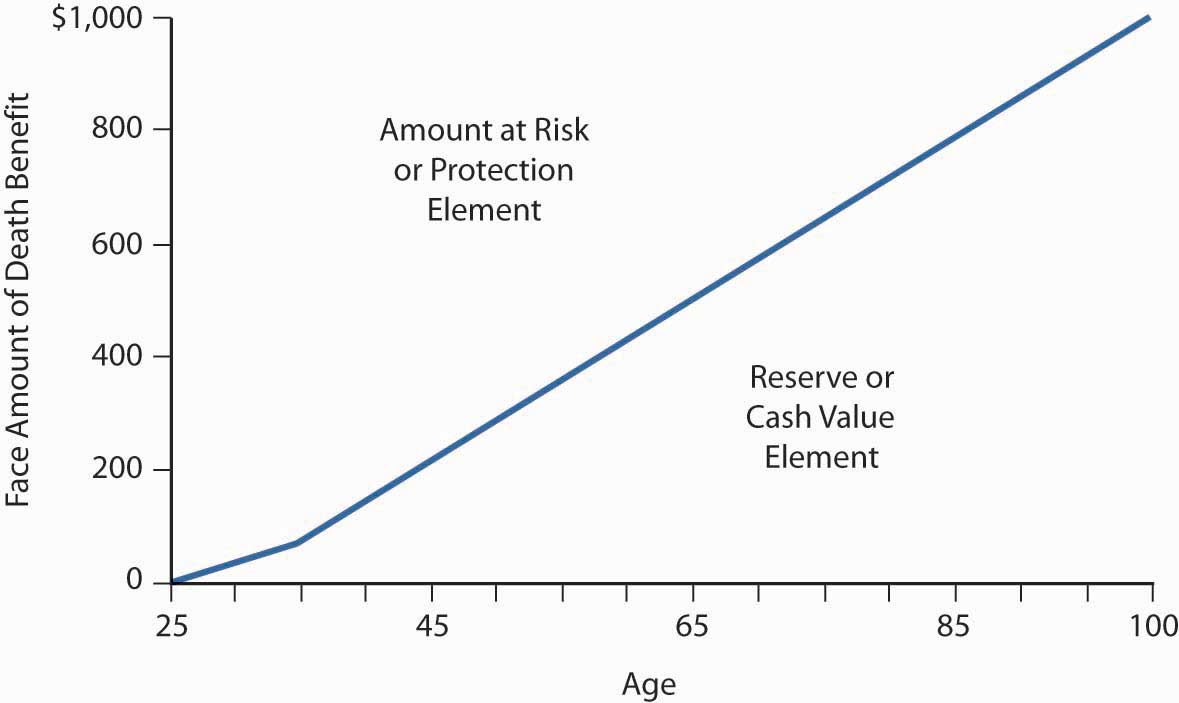

Despite the lack of cash value term life. However there are different types of life insurance some that offer a surrender value known as whole life policies and some that dont called term life insurance policies. Cash surrender value applies to the savings element of whole life insurance policies payable before death.

These policies are more expensive than term life insurance and the cash value component offers some additional flexibility. Rop return of premium term costs more than regular term life insurance but does return the premiums paid in at the end of the term if the insured is still alive. How much you actually receive from the cash value of your life insurance policy is based on the surrender value which can sometimes be much lower.

When you cash out your policy there may be fees charged by the insurance company. However during the early years of a whole life insurance policy the savings portion. When you decide to surrender your life insurance policy you are essentially requesting to cancel the life insurance in exchange for any cash value that has accumulated.

Cash surrender value term life insurance if you are looking for low cost insurance then our online insurance quotes service will help you find a provider that works for you. Permanent insurance term and permanent life insurance represent.

How Do I Cancel My Life Insurance Policy Cancel Life Insurance

How Do I Cancel My Life Insurance Policy Cancel Life Insurance

Cash Surrender Value Definition

Cash Surrender Value Definition

What Is The Difference Between Term Life And Whole Life Policy

What Is The Difference Between Term Life And Whole Life Policy

Life Settlements Understanding The Benefits Of And Properly

Life Settlements Understanding The Benefits Of And Properly

Cash Surrender Value Of A Life Insurance Policy Life Insurance

Cash Surrender Value Of A Life Insurance Policy Life Insurance

Solved Buildings Cash In Bank Cash On Hand Cash Surren

Solved Buildings Cash In Bank Cash On Hand Cash Surren

Single Premium Whole Life The Pros And Cons Of A Mec

Single Premium Whole Life The Pros And Cons Of A Mec

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

Low Cost Life Insurance Cash Surrender Value Of Life Insurance

Low Cost Life Insurance Cash Surrender Value Of Life Insurance

Surrender Value Meaning In Life Insurance And How It S Calculated

Surrender Value Meaning In Life Insurance And How It S Calculated

6 Ways To Capture The Cash Value In Life Insurance

6 Ways To Capture The Cash Value In Life Insurance

Life Health Insurance Chapter Ppt Download

Life Health Insurance Chapter Ppt Download

/Cashsurrendervalueinlifeinsurancecouplediscussingcashingout-5a66a9a7c9439a0019bd5f4f.jpg) How Cash Surrender Value Is Calculated On Insurance

How Cash Surrender Value Is Calculated On Insurance

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

Life Insurance Policies Life Insurance Policies Cash Surrender Value

Life Insurance Policies Life Insurance Policies Cash Surrender Value

:max_bytes(150000):strip_icc()/GettyImages-1146740420-483e4e9518b54183aa7ebbbb846b2341.jpg) Cash Surrender Value Definition

Cash Surrender Value Definition

Pacific Life Insurance Company Flex Protector Ii An Interest

Pacific Life Insurance Company Flex Protector Ii An Interest

Term Life Vs Whole Life Insurance Differences Explained

Term Life Vs Whole Life Insurance Differences Explained

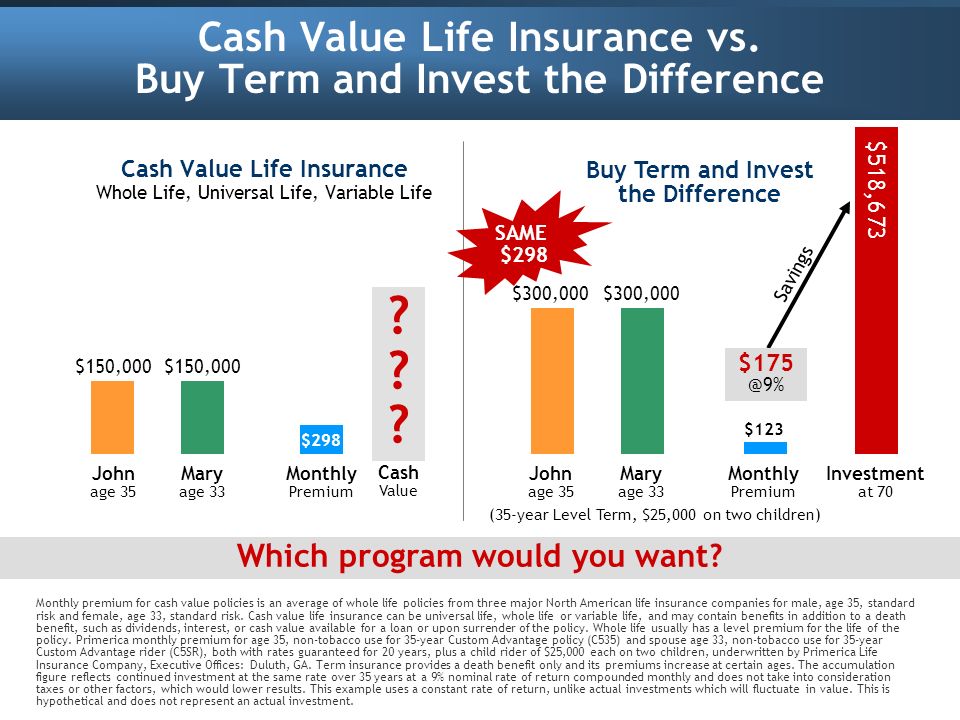

Why Almost Every Life Insurance Policy With Cash Value Stinks

Why Almost Every Life Insurance Policy With Cash Value Stinks