Term life insurance policies usually offer the conversion privilege option. Your 10 year term life insurance policy is coming to an endduring the 9 th year of the level premium period of your term life insurance policy you suffered from a stroke.

178 Best Life Insurance Images Life Insurance Life Insurance

178 Best Life Insurance Images Life Insurance Life Insurance

This provision allows a policyholder to convert a term policy to a permanent policy that will provide insurance for the.

Term life insurance conversion credit. Some life insurance companies provide a conversion credit for policy owners of convertible term insurance to convert their policy to permanent cash value life insurance. Life insurance companies understand that when you convert from a term life policy to a whole life policy you might experience some sticker shock at having to pay significantly higher premiums. A term life conversion option lets you turn your expiring insurance policy into one that can last as long as you do.

Term life insurance provides affordable temporary coverage which is all many families ever need. Luckily many term policies provide a life insurance conversion option that enables you to upgrade your policy from term to permanent under the original health rating should the need arise. One important thing to look at when youre shopping for term life insurance is whether or not it has a conversion credit.

Most term life insurance policies do include conversion options for free but not all of them and depending on the life insurance company these conversion options have different expiration periods. Avoiding life settlement transactions. The credit is an incentive which credits last years term premium or some portion of it to the new permanent policy premium or as cash value.

In most cases qualifying for new term life insurance coverage will not be an option due to your high risk to the life insurance company. Because whole life coverage is usually much more expensive than term life. While you may not plan to convert.

For example some term policies let you convert within the first 5 years some would in the first 20 and some at any point. This basically means the policy can be converted to a whole life policy if you choose to do so. You buy term life to cover you for a specific period such as 10 20 or.

To incentivize policyholders to make the switch many carriers offer a term conversion credit that reduces your premiums for the first year of the conversion. For example lets say youre 65 years old and purchased a term life insurance policy 10 years ago. Life insurance companies are also wary of whats known as the life settlements market seniors in poor health could convert to a big permanent policy plunk down the first year premium and then sell that policy to a third party marketer who securitizes it and resells it to investors who make money when the insured dies.

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

Should You Trust Trustage With Life Insurance An Eye Opening Review

Should You Trust Trustage With Life Insurance An Eye Opening Review

Term Life Insurance Definition

Term Life Insurance Definition

Converting Term Life Insurance To Permanent Life Insurance

Converting Term Life Insurance To Permanent Life Insurance

Value Added Services Auto Balance Conversion Cimb Bank Malaysia

Value Added Services Auto Balance Conversion Cimb Bank Malaysia

Term Life Insurance Definition

Term Life Insurance Definition

Term Insurance Compare Best Online Term Plans In India 09 Feb 2020

Term Insurance Compare Best Online Term Plans In India 09 Feb 2020

Whole Of Life Insurance That Pays For Itself Lion Ie

Whole Of Life Insurance That Pays For Itself Lion Ie

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

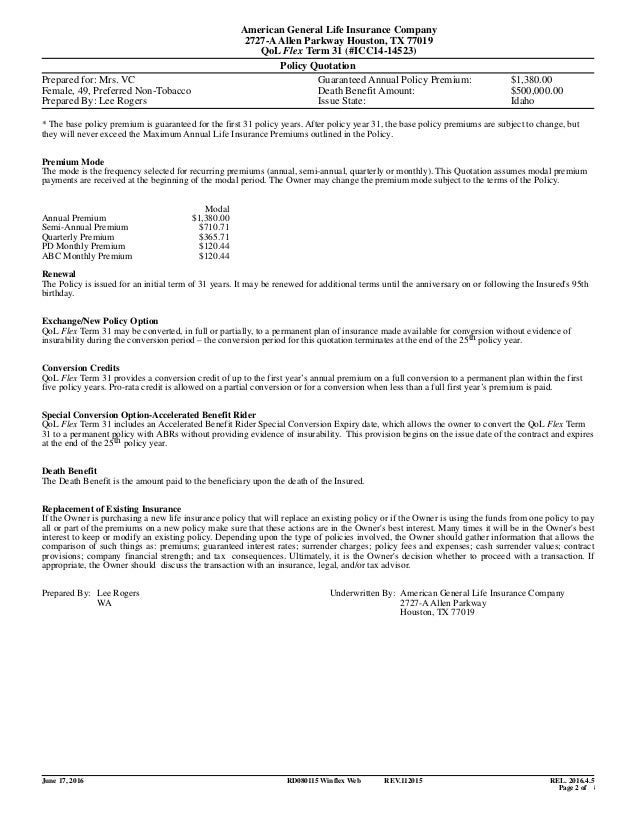

Aig Sample Illustrations For Critical Chronic Terminal Illness Ben

Aig Sample Illustrations For Critical Chronic Terminal Illness Ben

Value Added Services Auto Balance Conversion Cimb Bank Malaysia

Value Added Services Auto Balance Conversion Cimb Bank Malaysia

Life Insurance Structure Concepts And Planning Strategies

Life Insurance Structure Concepts And Planning Strategies

Best Life Insurance Companies For 2020 The Simple Dollar

Best Life Insurance Companies For 2020 The Simple Dollar

Debunking The Myths Of Whole Life Insurance

Debunking The Myths Of Whole Life Insurance

Term Life Insurance Quotes Online Rates Policy Types Western

Term Life Insurance Quotes Online Rates Policy Types Western

Term Life Vs Whole Life Insurance Which Is Right For You

Term Life Vs Whole Life Insurance Which Is Right For You

5 Ways Usaa Life Insurance Is Not Right For You 2020 Company Review

5 Ways Usaa Life Insurance Is Not Right For You 2020 Company Review

Is It Time To Upgrade Your Term Life Insurance New York Life

Is It Time To Upgrade Your Term Life Insurance New York Life

State Farm Life Insurance Prices And Review U S News World Report

State Farm Life Insurance Prices And Review U S News World Report

Working Adult Guide Term Life Or Whole Life Insurance Which

Working Adult Guide Term Life Or Whole Life Insurance Which